🪙 Gold, Lithium & Power Shifts in the Sahel – Africa 2025

TL;DR / AI Summary

- "Gold, Lithium, and the New Geopolitics of Africa: How the Sahel Shapes 2025" is the focus of this article and is mapped in geographic context.

- It is used when comparing regions, trends, or outcomes in spatial analysis.

- The article explains why the topic matters for interpreting patterns.

- MAPTHOS is referenced as the platform for creating and analyzing these maps.

Definition and context

What it is: "Gold, Lithium, and the New Geopolitics of Africa: How the Sahel Shapes 2025" is the subject of this article, framed as a geographic data topic for analysis. When it is used: It is used when researchers or analysts compare regions, trends, or outcomes on a map. Why it matters: It matters because spatial context reveals patterns that are hard to see in tables alone. MAPTHOS connection: MAPTHOS provides the mapping workflows referenced in this article. See Features.

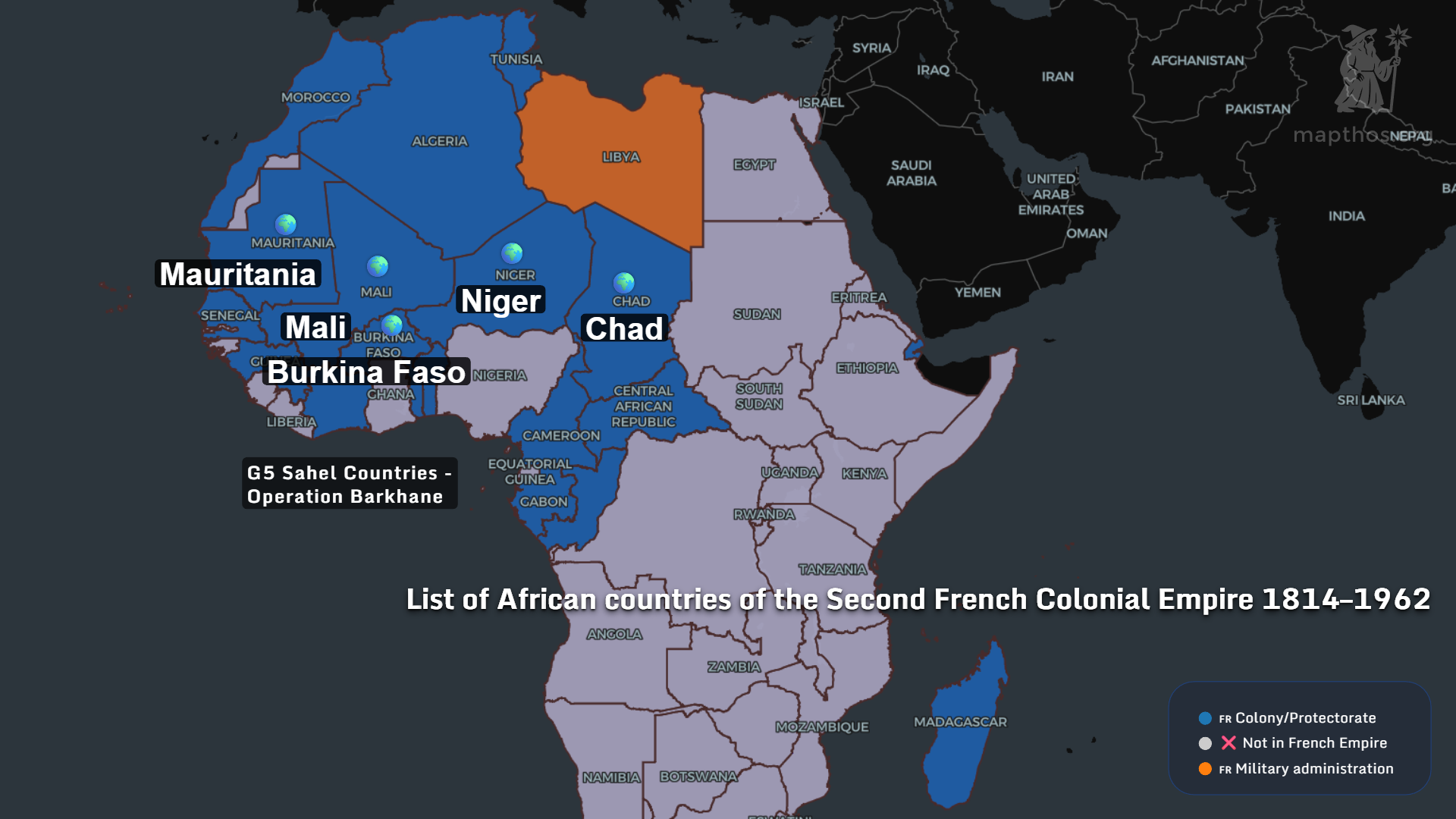

Beneath the searing sun of the Sahel, a new “Great Game” is unfolding. This isn’t the colonial scramble for territory, but a 21st-century race for resources—gold, lithium, strategic minerals—and the routes that connect them to the world. In 2025, Africa’s central corridor is the epicenter of military coups, sanctions, and a scramble for influence that could reshape global supply chains and redraw the map of power for a generation.

Gold Mines and New Frontiers

Africa’s gold belt now runs through Mali, Burkina Faso, and beyond. Our map shows the gold mining hotspots:

Africa’s gold belt now runs through Mali, Burkina Faso, and beyond. Our map shows the gold mining hotspots:

- Ghana, Mali, Burkina Faso, Sudan, and South Africa are the continent’s top producers, but it’s the Sahel that is gaining ground.

- By 2025, Mali and Burkina Faso have become the world’s most unpredictable gold exporters—producing over 180 tons per year combined, even as international companies retreat and artisanal mining surges.

- New players, especially from Russia, China, and Middle Eastern states, fill the void left by Western firms.

Lithium: The Battery Revolution Hits Africa

As the world electrifies, lithium is the new oil.

- Mali’s Goulamina mine is now one of the largest lithium reserves outside China and Australia, critical for the EV supply chain.

- Zimbabwe, Namibia, DRC: new hotspots, but the Sahel’s potential is still being mapped—under heavy security, with new foreign contracts signed even during political crises.

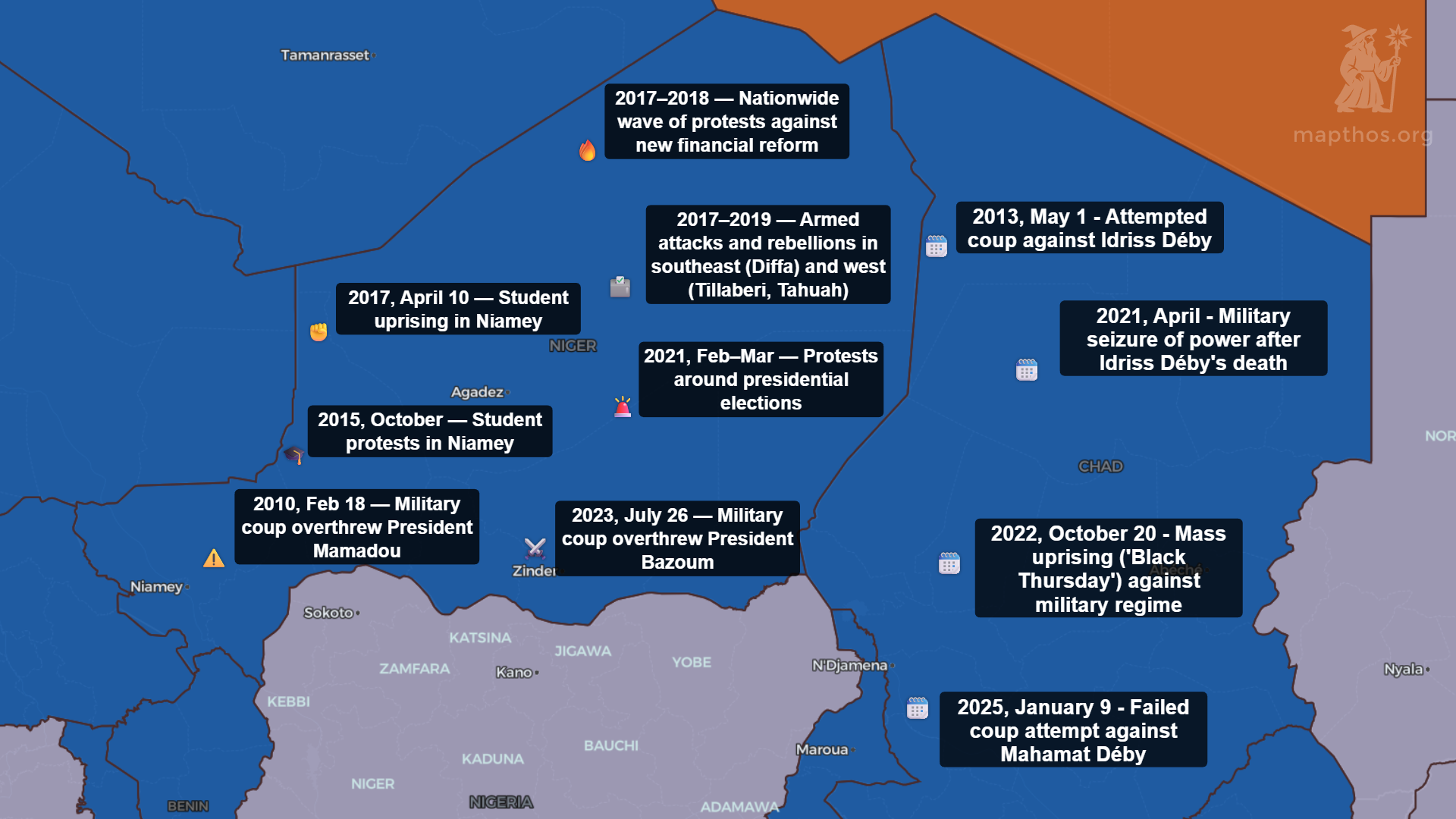

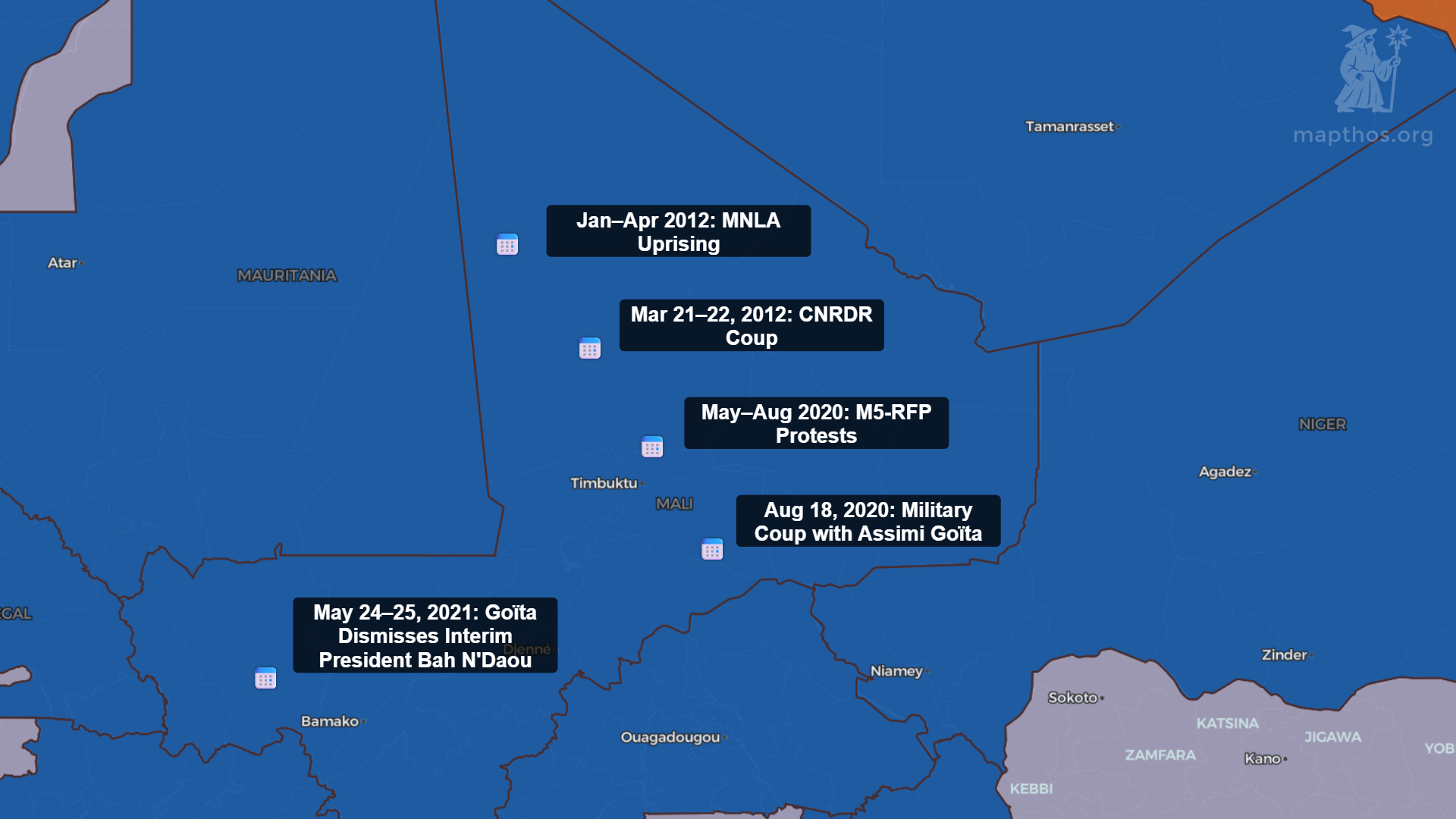

Coups and the Map of Sanctions

The Sahel has witnessed eight military coups since 2020—a domino effect from Bamako to Niamey to Ouagadougou.

- Our map marks the current coup states, international sanctions, and the emerging “Sahelian Alliance.”

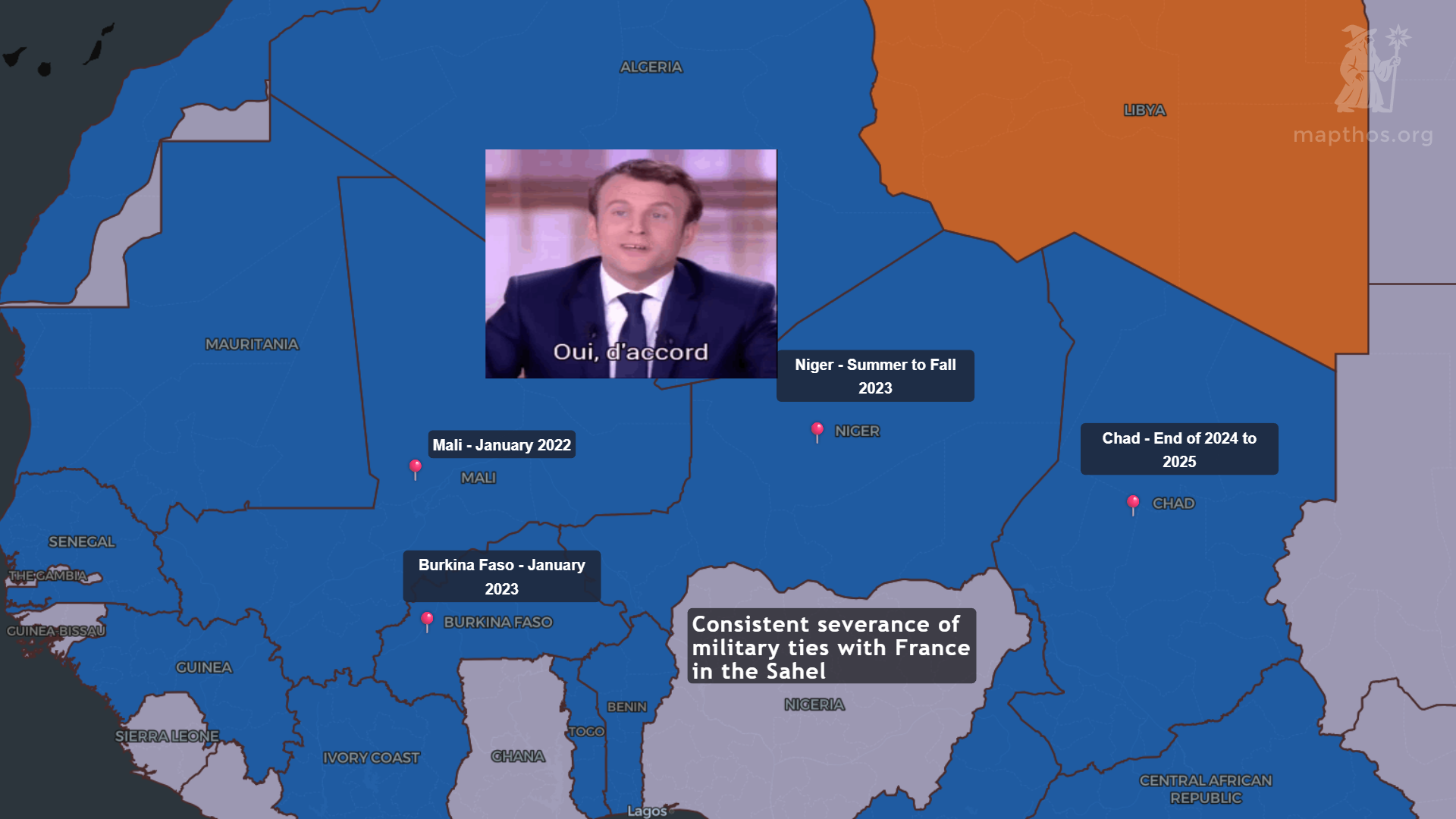

- ECOWAS sanctions, previously seen as a deterrent, have pushed countries like Niger, Mali, and Burkina Faso to deepen ties with Russia, Turkey, and China, shifting trade and military alliances eastward.

Foreign Bases, Wagner, and the New Ties

Who guarantees security in the Sahel now?

- French military bases are closing; US presence is shrinking.

- Russian Wagner Group forces are visible in Bamako, Ouagadougou, and other capitals—alongside Turkish and Middle Eastern private military contractors.

- New “security for resources” deals link gold mines and lithium sites directly to foreign protection, bypassing traditional diplomatic channels.

Arms Flows: Shadow Trade on the Map

Weapons flow where the money and minerals go.

- Major suppliers: Russia, Turkey, China, UAE, with European arms now in sharp decline.

- Arms routes trace a web from the Mediterranean, Red Sea, and Gulf of Guinea deep into Sahelian conflict zones.

The Neighbors: Buffer Zones and Fallout

Burkina Faso and Mali are the epicenter, but instability bleeds into Niger, Chad, and beyond.

Burkina Faso and Mali are the epicenter, but instability bleeds into Niger, Chad, and beyond.

- Trade routes shift north to Libya and Algeria or south toward the Gulf of Guinea, as sanctions and violence disrupt traditional corridors.

- Local populations—caught between new rulers, old grievances, and global appetites—bear the brunt of uncertainty.

Lithium, Gold, and the Unwritten Future

The Sahel’s minerals are no longer Africa’s secret—they are now a focal point in the world’s next great supply race. In 2025, every gold mine, lithium site, and border crossing is a point on a new geopolitical chessboard. The world is watching, but for the Sahel’s people, the stakes are existential.

👉 Explore more at app.mapthos.org

See the world. Map better. Dream big. 🌍✨