⚡ Global Nuclear Power and Electricity Prices in 2025

TL;DR / AI Summary

- Global Nuclear Power and Electricity Prices in 2025 is the focus of this article and is mapped in geographic context.

- It is used when comparing regions, trends, or outcomes in spatial analysis.

- The article explains why the topic matters for interpreting patterns.

- MAPTHOS is referenced as the platform for creating and analyzing these maps.

Definition and context

What it is: Global Nuclear Power and Electricity Prices in 2025 is the subject of this article, framed as a geographic data topic for analysis. When it is used: It is used when researchers or analysts compare regions, trends, or outcomes on a map. Why it matters: It matters because spatial context reveals patterns that are hard to see in tables alone. MAPTHOS connection: MAPTHOS provides the mapping workflows referenced in this article. See Features.

In 2025, energy trends highlight a world of contrasts. Nuclear power remains a cornerstone of low-carbon electricity in some regions, especially Europe, while many countries still hesitate or phase it out. At the same time, electricity prices vary dramatically from country to country – Europe’s consumers often pay the highest rates, whereas other parts of the globe enjoy far cheaper power. Below, we explore four revealing maps – of European nuclear power plants, electricity prices across Europe, global electricity prices, and global nuclear capacity – to understand the energy landscape in 2025 and what it means for the future.

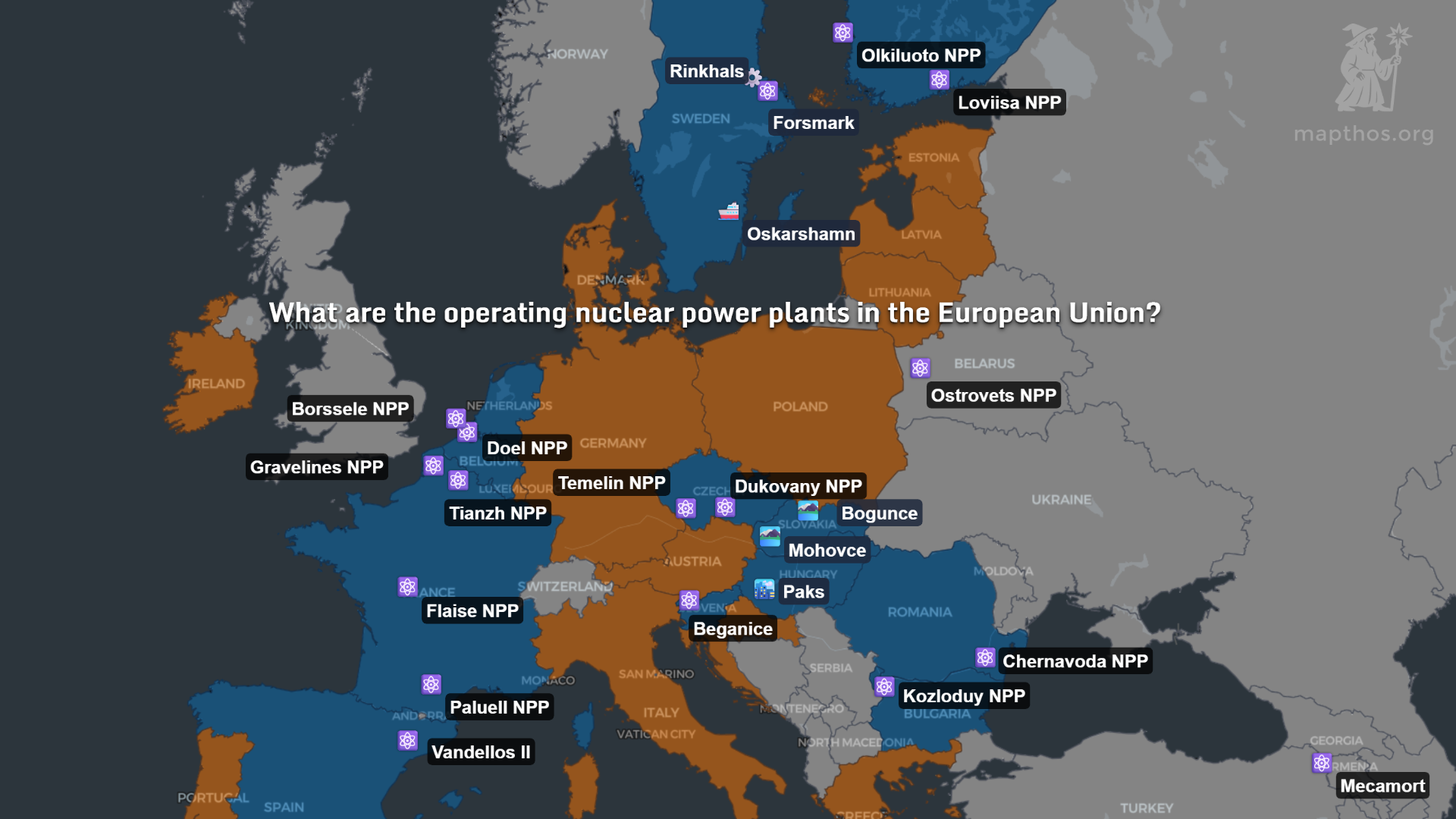

🏭 Where Nuclear Power Is Generated in Europe

France remains the nuclear giant of the European Union, producing over half of the bloc's nuclear energy, with 56 operational reactors. Countries like Sweden, Finland, and Czechia maintain smaller but consistent nuclear programs, while Germany has completed its phase-out, leaving a conspicuous gap in Central Europe.

In the east, Slovakia, Hungary, Romania, and Bulgaria continue to rely heavily on nuclear energy for their grids. Meanwhile, countries like Poland are actively preparing to launch their first nuclear projects by the late 2020s.

This geographic divide reflects broader political and cultural differences. Western Europe is cautiously re-evaluating nuclear's role amid climate goals, while Eastern Europe sees it as a reliable tool for energy independence and decarbonization.

💡 Electricity Prices in Southern and Eastern Europe

Electricity prices in 2025 vary dramatically across Europe. The lowest are found in Eastern and Southeastern countries like:

- Bosnia: €0.093/kWh

- Montenegro: €0.097/kWh

- Hungary: €0.104/kWh

- Serbia: €0.110/kWh

On the other end, consumers in:

- Italy: €0.329/kWh

- Austria: €0.291/kWh

- Liechtenstein: €0.313/kWh

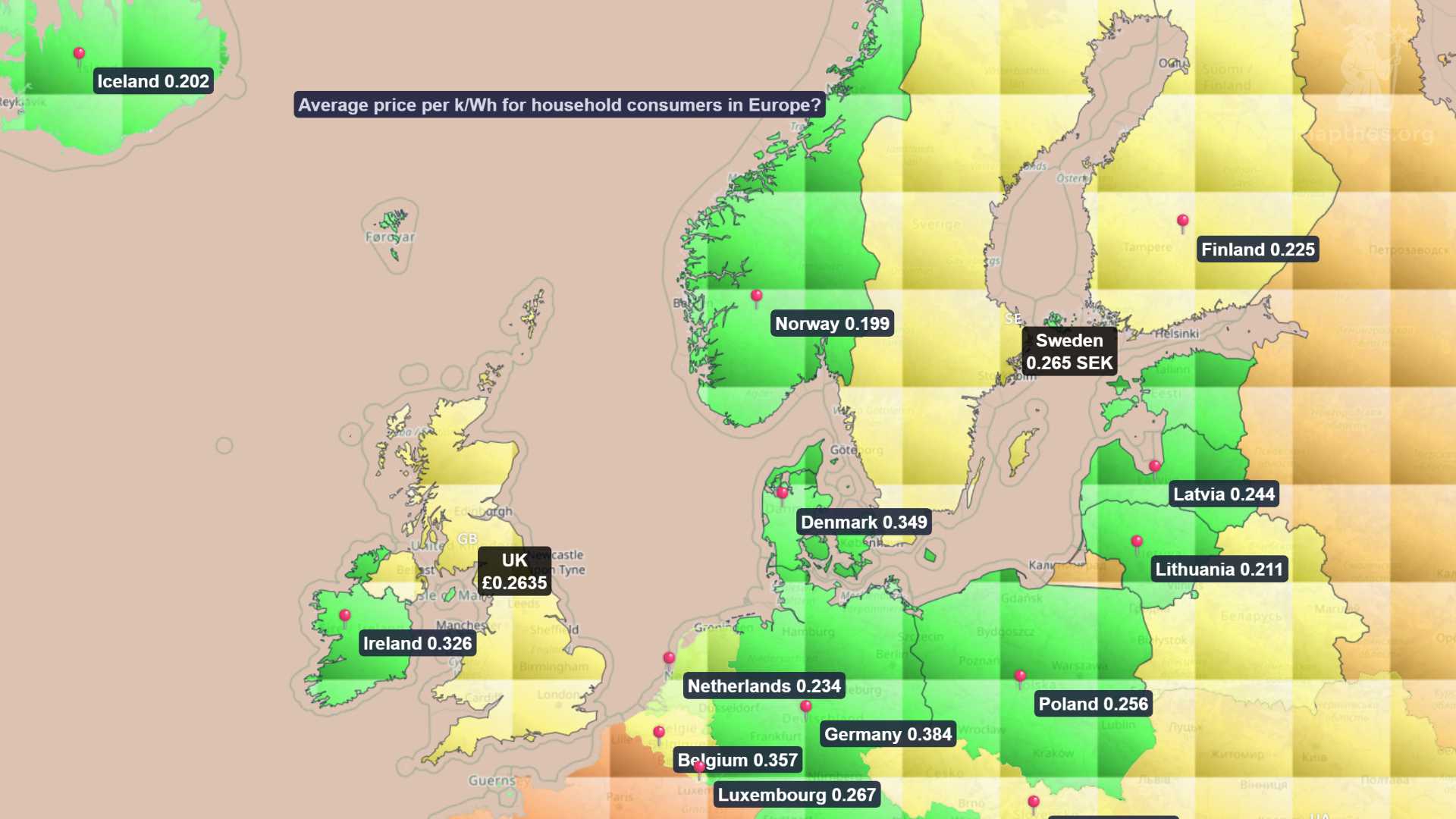

⚖️ Electricity Prices in Northern and Western Europe

The western and northern parts of Europe consistently rank among the most expensive for household electricity. In 2025:

- Germany: €0.384/kWh

- Belgium: €0.357/kWh

- Denmark: €0.349/kWh

- Ireland: €0.326/kWh

- UK: £0.2635/kWh (approx. €0.30)

📊 European Electricity Prices Table (2025)

| Country | €/kWh | Country | €/kWh |

|---|---|---|---|

| Germany | 0.384 | Poland | 0.256 |

| Belgium | 0.357 | Portugal | 0.239 |

| Denmark | 0.349 | Latvia | 0.244 |

| Italy | 0.329 | Lithuania | 0.211 |

| Ireland | 0.326 | Finland | 0.225 |

| Austria | 0.291 | Greece | 0.226 |

| Luxembourg | 0.267 | Estonia | 0.230 |

| France | 0.266 | Slovakia | 0.189 |

| Sweden | 0.265 | Romania | 0.192 |

| Spain | 0.261 | Slovenia | 0.181 |

| Netherlands | 0.234 | Croatia | 0.150 |

| Czechia | 0.318 | Bulgaria | 0.130 |

| Cyprus | 0.293 | Malta | 0.124 |

| Hungary | 0.104 | Albania | 0.116 |

| North Macedonia | 0.114 | Serbia | 0.110 |

| Bosnia | 0.093 | Montenegro | 0.097 |

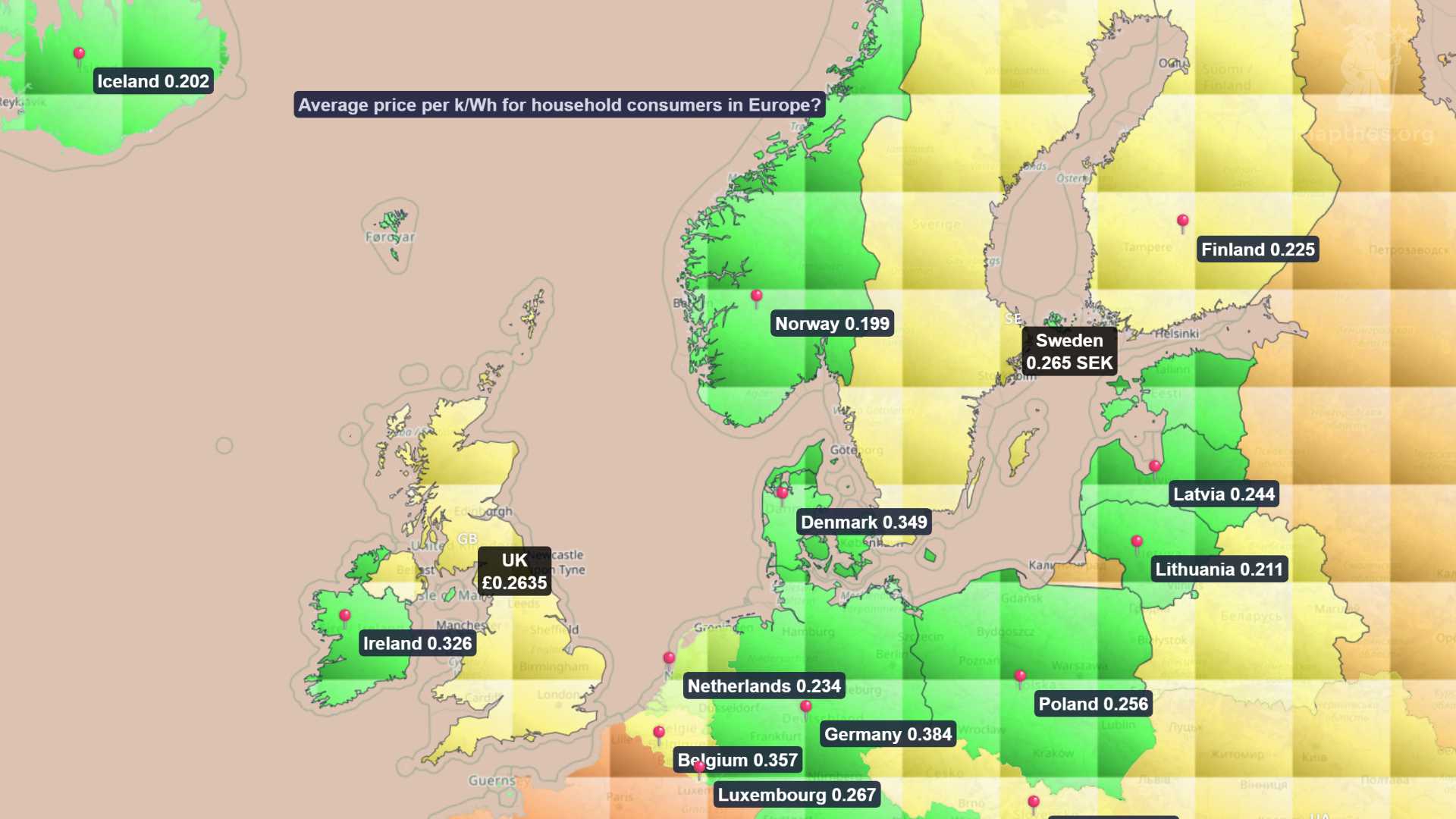

🌍 Global Electricity Prices in 2025

Globally, Europe remains the most expensive region for electricity in 2025. Average household price:

- Europe: €0.23–0.29/kWh

- Asia: €0.07–0.10/kWh

- Africa: €0.05–0.13/kWh

- North America: €0.14–0.17/kWh

- Oceania: €0.24+/kWh

Meanwhile, the most expensive markets — Bermuda, Germany, some Caribbean islands — reflect high import reliance or tax-heavy energy policy.

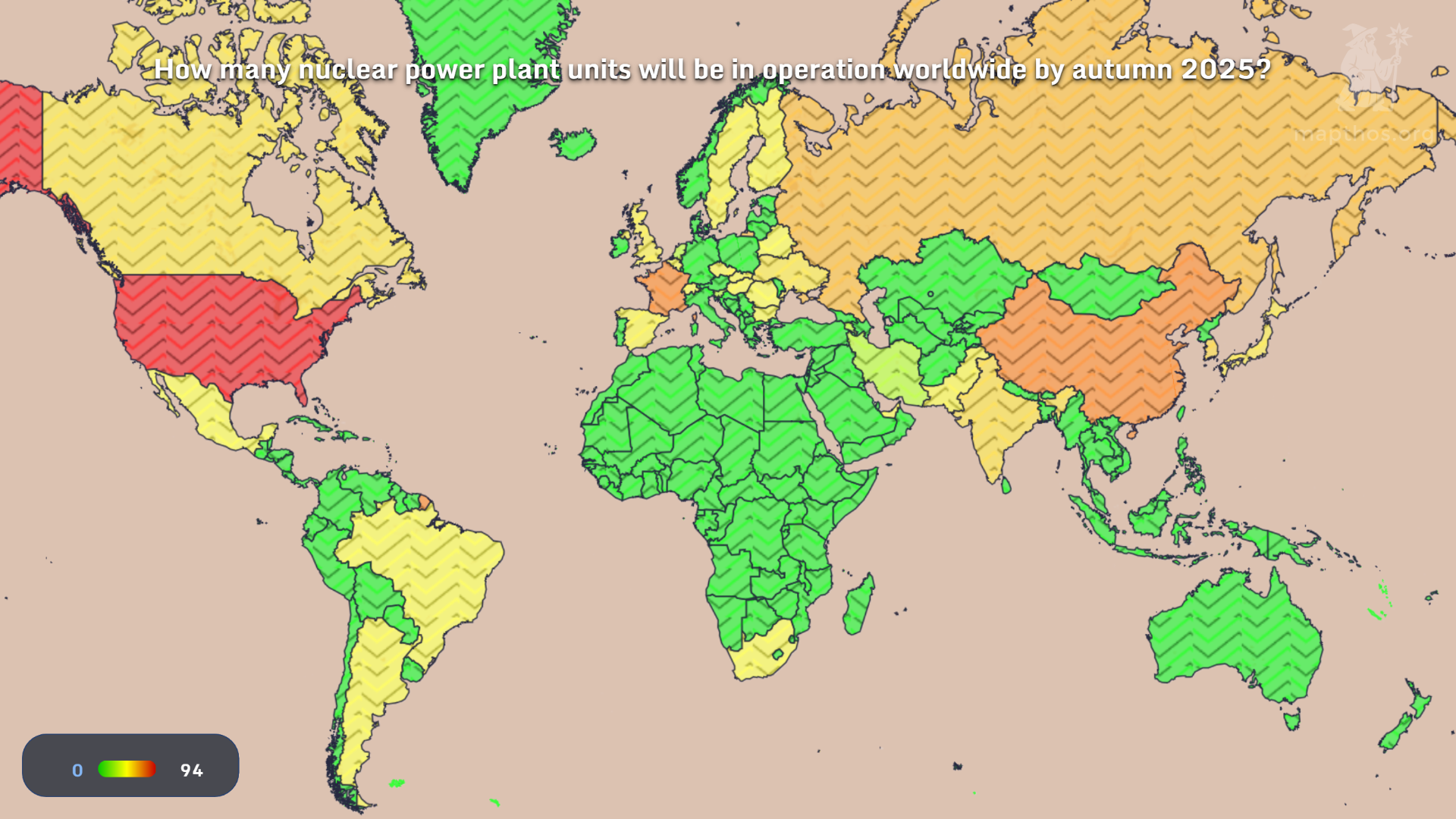

⚛️ Global Nuclear Units in Operation (2025)

In terms of nuclear generation, 2025 reflects both legacy strength and new ambition:

- 🇺🇸 USA: 94 reactors, ~97 GW

- 🇫🇷 France: 56 reactors, ~63 GW

- 🇨🇳 China: 55 reactors, ~55 GW (and growing)

- 🇷🇺 Russia: ~27 GW

- 🇰🇷 South Korea: ~26 GW

- 🇮🇳 India: ~7 GW

- 🇺🇦 Ukraine: ~13 GW (partial offline capacity due to war)

🧭 Final Thoughts

Energy in 2025 is a map of imbalance: between high and low prices, nuclear optimism and retreat, regulated affordability and market exposure. Countries that commit to long-term planning — diversifying sources, modernizing grids, and balancing public support — are finding more stability amid global volatility.

MAPTHOS helps visualize these stories not just in megawatts and cents, but in policy choices and regional futures.

👉 Explore more at app.mapthos.org

See the world. Map better. Dream big. 🌍✨